Spotting a Good Analysis

Good afternoon everyone. I hope you enjoyed that blast from the past last week. I know that for me it was cool to look back at how I was thinking about stocks back in college. It's pretty funny for me to see what I considered good research and comprehensive valuation. A lot has changed since then and this article (which I promise will be a lot shorter than last week) will dive into what I got right, what I got wrong, and how I could have improved my research and model. Let's get started.

Investment Thesis

My investment thesis back in early 2019 was very simple, Spotify was platform agnostic, meaning that it could be downloaded and used on any mobile device or computer, while Apple Music, Spotify’s biggest competitor, was only available on Apple devices. Is this a good enough investment thesis to justify risking thousands of dollars? Probably not, at least not on its own. These days my investment theses almost always include some sort of valuation, market growth opportunity, or some other quantifiable metric that can be used as proof, rather than evidence, of a stock’s growth potential.

If we take the overall quality of the investment thesis out and just evaluate what the thesis actually was, it was essentially correct. At the time Apple Music was only available on Apple devices whereas Spotify was, and is, platform agnostic, giving Spotify a much larger Total Addressable Market (TAM) worldwide. These days, it is possible to download Apple Music onto a PC or Windows OS and Android devices so this edge doesn’t necessarily hold true anymore. However, I would argue that Apple’s brand is not as strong internationally as it is in the US and Spotify has already established itself globally as the market leader in music streaming.

There are a few more competitors than I gave credit to in the original article. Amazon music was in its infancy at the time and honestly I'm not sure if anyone even uses it today. Additionally, there were a few more competitors that I didn’t mention in the original report. Those were Soundcloud, which was big for independent musicians, and Pandora was a player in the market, even though it was already on the decline.

I am confident that I was aware of these market players at the time of the original writing, but I must not have considered them major competitors (I still don’t) and neither of them are publicly traded companies which made it very difficult to get financial information on them for comparative purposes. This would not be an excuse these days, you cannot simply exclude a competitor because it is not publicly traded. Back then I didn’t know how to research companies very effectively and the SEC website was my main source of financial information.

The last competitor in the space that I mentioned in the original article was Tencent Music. Tencent has a virtual lock on the Chinese music market boasting over 800 million monthly active users and controlling an estimated 60% of the Chinese market. In the original report I predicted that Spotify would try to enter and compete in the Chinese market and it appears that I was wrong. However, Spotify clearly had a strategy with this in mind, instead of directly competing with Tencent, they bought a stake in the company. As of 2023 Spotify owned about 17% of Tencent Music (NYSE: TME).

Value Drivers

I spent a lot of time in this section of the original article talking about the number of iPhones being sold in countries around the world and trying to make the point that Spotify had a larger TAM (an acronym I didn’t know at the time). While this certainly was a big factor back in 2019 it is less so now that Apple Music is technically platform agnostic as well.

I think the bigger problem with this section in the original report is that it basically just turned into a report comparing Spotify to Apple. Again, this is important as Apple was and is one of Spotify’s biggest competitors, but it is not even close to the only, or even the biggest factor that would drive stock performance. Spotify could be vastly superior to Apple but if Spotify was losing incredible amounts of money would it still be a good stock to buy? Maybe, making money isn’t as important as it used to be when talking about stock price appreciation. But it could also make Spotify a very risky investment.

The last paragraph that I wrote in this section is actually what I find most interesting these days, which is why it is unfortunate that I did not spend more time on it in the original report. For those of you who don’t have all of my articles memorized yet, the paragraph that I am referring to touched briefly on Spotify’s foray into podcasts. Back in 2019 podcasts were still a new and unproven concept (it's crazy how much they have grown since), but Spotify was planning on investing $500 million into that segment, an investment that I thought could be lucrative.

Just over a year after I wrote the original report Spotify signed Joe Rogan to a historic $200 million exclusive deal which has become a windfall for the company. I am not arrogant enough to claim I knew this deal was coming or that I even thought that podcasts would get as big as they are, but I was correct that it would be a good investment. As of 2023 Spotify accounted for a third of global podcast listens making it the largest podcasting platform globally. While the segment still loses money as of full year 2023, they are very close to break-even and I predict that the segment will become cash flow positive in 2024.

One more thing that I will add to this section is Spotify’s push into audiobooks. I did not include this as a value driver in the original report because they did not invest in this segment until much more recently. However, as of Q4 2023 Spotify is now the second largest audiobook streaming service behind Amazon’s Audible app. As a big fan of audiobooks I am excited for this investment which could be a value driver similar to podcasts in 2019.

Risks

I’m not going to spend too long on risks, a lot of what I wrote in these sections was similar across all of my reports and are standard risks that come with all companies such as missing earnings and fraud. However, there are a few that I would like to touch on.

I did highlight that a risk for Spotify would be if Apple Music followed Spotify in becoming platform agnostic which they since have. However, it has clearly not had a big impact on Spotify’s business. I stand by what I said earlier in this article, that Spotify is a much bigger brand globally than Apple and therefore enjoys first mover advantage. I also touched on the risk of not being able to compete in the Chinese market which has also proven out to be true. But as we already touched on, Spotify still enjoys a share of the market through ownership of Tencent Music.

Finally, I would like to just point out one more risk that I wrote about that I think is pretty funny now looking back. I wrote that it would be a threat to Spotify if artists started pulling their music off of the platform. As we have now seen many times since 2019, there have been a revolving door of artists that have pulled their music from Spotify for reasons varying from royalties to politics. Not only has this had no impact on the business, but almost all of the artists that pulled their music have returned. Most famously (although this was back in 2014) Taylor Swift pulled her catalog from Spotify and returned after a brief hiatus without harming the business.

Technical Analysis

I’m so sorry that you had to read this section. My first mistake and probably the biggest mistake of this whole report was even attempting to do technical analysis. Take a minute to look back at the original report and laugh at how silly I was to put any effort or time into analyzing charts. What even are Bollinger Bands or the Relative Strength Index? I wish you could see me rolling my eyes at the Net Money Flow part, how embarrassing.

I’m truly sorry you had to read that, but it's not even the worst example. I found another old report where I went way more in depth on the technical side and talked about these things called Golden Crosses and Death Crosses. Maybe I will post that another time to show you just how naïve I was back then.

But in all seriousness, I truly believe that technical analysis is basically worthless when evaluating stocks. Even in the original report I state the relative strength of Spotify indicates a hold rating but I am still saying to buy the stock in that report. Again, I state that there is a net money outflow, which is a bearish signal, but flip around the logic and say that the stock is oversold. This is the fundamental problem with technical analysis, any indicator can be used to make the case for a buy signal or a sell signal. I talk more about technical analysis in my article How I Invest, which you can check out by clicking here.

Fundamental Analysis

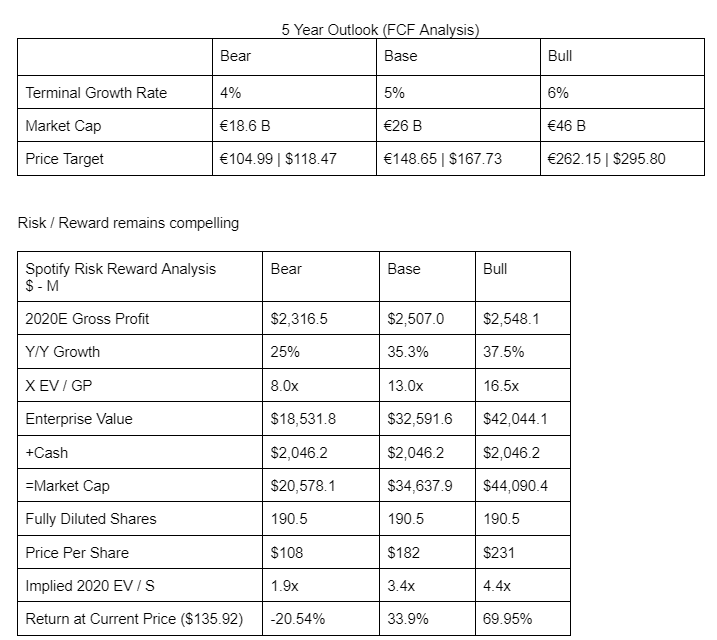

In this section I will just post the assumptions that I made in 2019 vs the actuals as of 2020 year end so you can see for yourself how I compared with what I was predicting. All numbers are in Euros unless otherwise stated. Also I will put in a caveat that COVID happened in 2020 and most definitely affected the financials in some way.

Original Assumptions:

2020 Actuals:

Gross Profit: 2.0 billion

YoY Growth: 17%

Enterprise Value: $58.7 billion

Market Cap: $59.8 billion

Price per share: $314.66

The first thing that stood out to me about this analysis is how much I didn’t know. There was a DCF model that I built in Excel at the time that I cannot find at the moment, but just in terms of the metrics that I was using shows how much I still had to learn. Why on Earth did I care about gross profit? That is important from a corporate perspective but generally not so much when doing stock valuation. The only reason to find gross profit is on the way to finding free cash flow. Its pretty funny that I didn’t touch on free cash flow at all or even revenue which is also generally more important that gross profit.

Clearly my original assumptions were wrong. Whether due to COVID or maybe I was simply incorrect in my assumptions but the 2020 actual results were well below the bear case that I laid out back in 2019. However, for whatever reason, not only was Spotify’s stock above my bull case price target, it was pretty damn close to what I predicted, only about 6% off. How is it that Spotify’s actual results were 25% lower than my base case, but the stock ended up being 88% above my base case price target and 6% above my bull case target? Was it dumb luck? It might have been. But the reasons that stocks move as they do is a complicated subject and could have its own article (maybe it will). But to put it very simply, actual results are only a small fraction of what makes stocks move. What is vastly more important is expectations about the future.

Conclusion

I know I teased that I might update the DCF for Spotify and maybe give an updated price target, but alas, I don’t have one for you. I know, I know, I’m the worst. I have a lot going on right now, and while that is not an excuse to neglect this newsletter I do have some big things coming that I hope to share with you all very soon so I hope that you will forgive me. What I will say for now is that even without doing a DCF I am still bullish on Spotify as a company and as a stock. I don’t have a price target for you but I think it could be a decent investment.

Just as a little aside I will touch on Spotify’s 2023 actual results so we can see just how far they have come since 2019.

Net Revenue: 13.2 billion

Gross Profit: 3.4 billion

Market Cap: $59.6 billion

Stock price: $300.45

It seems like it would have been a good investment if I had bought the stock when I wrote the report at $136 per share, but if I had held it since then I would have been in for a roller coaster ride. The stock took off during 2020 when it hit an all time high but after COVID it dropped to a 5 year low of about $80 per share at the end of 2022 before climbing back up close to its all time high as off last Friday. The stock is up 59% year to date and 125% over the past 12 months. I will note that despite the drastic increases in stock price, Spotify is not a profitable company and lost just over 500 million euros last year, so be careful if you do decide to invest.

My final thoughts on my original report is that I was very young and didn’t know what a good research report looked like and didn’t know the best way to evaluate stocks. This is unsurprising as this was literally my first ever stock research report, but it is still funny to see how I viewed stocks back then. I have certainly come a long way since that original report was written.

I have found that this is a common theme in my old research reports. Like what I did comparing Spotify to Apple, I used to find one value driver that I thought was very important and used it to justify an investment. I discounted other areas of weakness for companies which was because I was incapable of seeing the whole picture then. Now that I have more experience, especially experience working in corporate finance, I now have a better picture of what is important to drive company value and it certainly takes more than a single value driver. As we have seen with this report, value drivers can decay. The one advantage that I highlighted so much that Spotify had over Apple, being platform agnostic, is no longer the case. But the question still remains: is Spotify a good investment? You be the judge.

Thank you all for reading this week. I hope you enjoyed this little two part article on my old reports. I know that it was fun for me to look back on the good old days. Stay tuned, there is a lot more coming.

Read more from Behind the Wall:

Week 1: The Best Thing That Ever Happened To Me: Being Laid Off

Week 2: The Case for a Recession

Week 3: Creating the Narrative: How to Lie With Statistics