Welcome back to Behind the Wall. I got a lot of feedback from my last article on Who the Market Would Vote For. While this feedback was both positive and negative the post itself did record numbers. I now understand why all of the mainstream media constantly uses click bait titles, they work! While I am sorry that I baited you, it's hard to resist repeating those numbers from last week.

Before we get into this week’s topic I want to remind you to become a member of my Patreon if you enjoy my work. I understand that a lot of you don’t want to subscribe because you already get enough emails, but I ask that you support me in another way by becoming a member if you want to continue to see content from Behind the Wall. I don’t want to put this newsletter behind a paywall but I will!

Alright, this week we are going to follow up on last week’s newsletter. Some of you clearly thought that I was pushing for Democrats in last week’s article and I promise you that was not my intention. I can understand why it might appear that way based on the (biased) dataset that was presented, but I tried very hard to explain why those market returns were not based on party but were merely random.

The ultimate conclusion of last week’s newsletter was that the presidential election, the president himself, and the president’s party have no effect on the stock market. This week’s newsletter will focus on the political body that actually does have a statistical correlation with market returns: congress. I promise, this week is not click bait; this week we will answer the question in the title.

If any of you had the opportunity to read the article from U.S. Bank that I attached to last week’s newsletter entitled How Presidential Elections Affect The Stock Market, I will be referencing this article quite a few times this week. If you have an issue with the conclusions expressed in this week's newsletter, take it up with U.S. Bank not me. For the sake of this newsletter I will be accepting U.S. Bank’s findings as accurate.

There is an old stereotype that republicans are pro business while democrats have fought hard to break up the largest corporations. While this may have been true historically, more recently the stance of both parties has shifted somewhat. We do not need to get into the weeds of each party’s specific viewpoint on big business, but I believe that it is still fair to say that mainstream republican policies tend to favor business more than mainstream democrat policies.

While I aim to avoid giving my opinion on politics in these types of newsletters, I do not feel that the above statement is an opinion but rather a fact. Republican policies tend to be more pro business. For example, a calling card of republican policy is tax cuts. We don’t have to debate the merits of tax cuts to recognize that fewer taxes means larger profits for businesses. The question then becomes do pro business policies impact the stock market? While most of us might intuitively say yes, the true answer may surprise you.

Before I go too far off the rails, I promised that I would answer the question in the title this week and I think this is actually the best place to start. So why does congress matter? If you say “they don’t” I certainly wouldn’t argue with you in principle, but in the context of how they affect the stock market I will still have to say for the sake of argument that they do.

Congress has a much more profound impact on the stock market than the president does. I briefly touched on this in last week’s newsletter and I probably should have expanded on it a little more (although I got a whole second newsletter out of the topic so I’m not complaining). The very simple reason behind this is that congress is the body that enacts laws. If the president wants to cut taxes, which we agreed above would benefit businesses, he actually doesn’t have the power to do so. The president would need congress to pass a law to lower taxes, thus passing the power to the legislative branch.

Another quick example of congress’s power over the economy is through regulatory agencies. Congress empowers regulatory bodies like the FDA to wield broad authority over entire market sectors. Not only does congress give these regulatory bodies their authority, but they also give them direction on where to impose their authority on the market (in conjunction with the president). Congress not only controls the economy through policy and law, but also through enforcement.

While there certainly is some scope of power that the president can wield through executive order, I would argue that power is limited and the president can use that power only to affect certain industries, not the whole market. A good example of this was early in his presidency, Biden unilaterally decided to not allow any more oil leases on public land. In this instance Biden’s executive order had an impact on the oil industry, but did not have the scope to affect the whole market.

While there is a balancing act between the branches of government (as the founders intended), to me it seems clear that congress wields the most power to affect the economy and by extension, the stock market. If we accept, as I obviously do, the conclusion of last week’s newsletter that the president and the presidential elections have very little impact on the market. And we accept that congress wields the power to drastically affect the economy. By logical extension we can deduce that congress is the most important branch of government that affects the stock market.

I would like to point out right now that while congress has the most impact on the market of any branch of government, they are not the most important factor in determining the direction of the market. Earnings, inflation, interest rates, and broader economic forces are all ultimately more important than the makeup of congress when determining the return of the market.

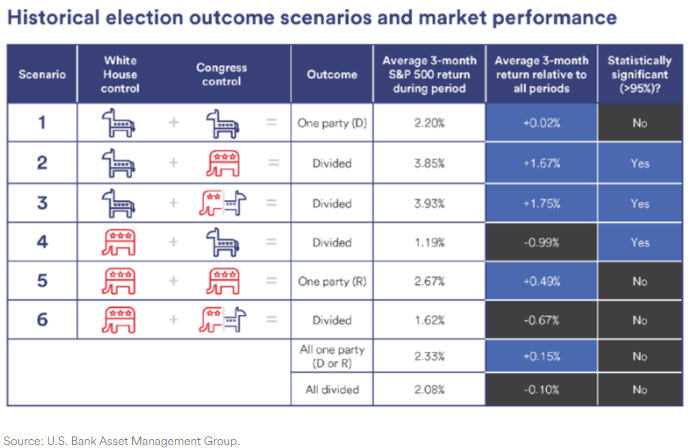

Alright, let's dive into the U.S. banks findings and see if we can explain them. Below is a screenshot from U.S. Bank’s article showing three month market return by party control of the presidency and congress.

As you can see, the only three statistically significant scenarios are three scenarios where there is a divided congress and presidency. Not only are these scenarios statistically significant, two of the scenarios (democrat president and republican congress; democrat president and divided congress) have the best overall market performance. But why does the market do better when there is division? Intuitively we thought that republican control would be the best scenario for big business.

While it is true that two of the top three outcomes involve a republican controlled congress, total republican control is not the best outcome for the markets. The answer may be a little counterintuitive, but the markets like gridlock. We as people tend to hate gridlock. Whether it is in traffic or when the president that we like is in power, we would prefer that the government (and the traffic) keeps moving. Markets on the other hand love stability and predictability above almost anything else. Management teams are better able to prepare for the future and craft strategy when the landscape is static and the status quo is well known.

While we hate gridlock, the market hates uncertainty. Uncertainty breeds volatility and companies tend to shelter and wait out volatility. When companies shelter, they cut back on investment and the economy (and the market) decline as a result. Nothing is more volatile for the markets than single party control of government. This is because there can be drastic policy shifts overnight with the minority party unable to stop change. On the flip side, when the government is divided the significantly fewer bills get passed into law and the status quo rarely changes.

While the article by U.S. Bank found the single party control to be statistically insignificant, it is still interesting to look at the market returns in these scenarios. The chart would indicate that the old stereotype of republicans being better for businesses (and by extension the stock market) to be accurate. It could appear that the market initially likes the idea of more pro business politicians in power.

As always, thanks for reading. Please subscribe if you don’t mind getting emails (you will only ever get emails from me with new articles) or become a member of my Patreon to support me monetarily. These contributions are what enables me to keep this newsletter free for everyone. Patreon.com/AlexSword

Take Another Glimpse Behind the Wall:

Based